What is a Speculative Investment?

In addition to the reduced interest rate subsidies announced last week, the Chicago Tribune reports:

Congress is poised to give bankruptcy judges more power to modify primary home mortgages in an attempt to halt the foreclosure crisis, a move Democrats and housing advocates have been pushing for two years in the face of stiff opposition from Republicans and the mortgage industry.So even if the contract of the loan states the bank can take over the home if the buyer doesn't pay (i.e. THEY ARE COLLATERALIZED LOANS), a judge can cram down the loan to an "affordable" level not necessary based on market price.

Besides a HUGE transfer of wealth from those taxpayers / investors that will fund this to those receiving the benefit, who else does it help? The NY Times reports Obama's view:

Mr. Obama said pointedly that it would not help “speculators who took risky bets” or “dishonest lenders who acted irresponsibly” or “folks who bought homes they knew from the beginning they would never be able to afford.”I couldn't possibly disagree more.

Definition #1 for speculator:

To engage in a course of reasoning often based on inconclusive evidence.Definition #2 for speculator:

To buy securities or property in the hope of selling them at a profitCombining definition #1 and #2 we get definition #3 for a speculator:

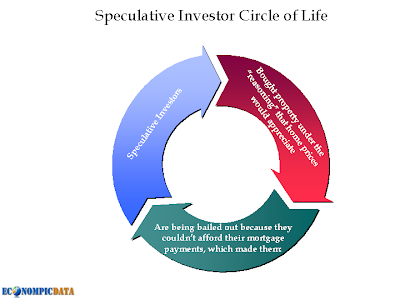

Engaging in the purchase of property, with the inconclusive evidence that it can be sold at a profitOr in an EconomPic form, we get the speculative investor "circle of life".

Real Life Mortgage "Moral Hazard" Plan

Not surprising, the AP reports real life sentiments as predicted by the Mortgage "Moral Hazard" Plan Matrix below:

Click for larger image

A quote by someone from the bottom right quadrant:

"I feel like I'm doing the right thing paying my mortgage, and now apparently I have to pay my neighbor's mortgage, too. People are really angry," said Kim Guymon, a stay-at-home mom who bought a three-bedroom home with her husband in suburban Seattle in 2001 and has watched it drop $150,000 in value since last summer.And the top left:

"It's just rewarding crooks," said the 38-year-old single mother, who said she turned down a bank's $100,000 mortgage offer five years ago because she knew she couldn't afford it.Personally, I'm in the bottom left quadrant. I was able to purchase a home that I could afford, but it would have been a significantly smaller place, in a less ideal location, and more expensive than what I was able to rent, thus it didn't seem like a good investment. I don't think many people would argue with this statement that a home is an investment; purchasing a home with an expectation that it will increase in value turns a house from just shelter (i.e. renting) into an investment. Furthermore, if someone buys a home and is not able to make monthly mortgage payments based upon the initial value of the home, then the home is not only an investment, it is a speculative investment (i.e. the buyer could only afford the home based on speculating that the value of the home would rise).

To get a better idea of someone in the top right quadrant of the matrix, lets go back to the AP article:

Rosa Valdez, a resident of Coachella, Calif., hopes it's not too late for her family to be helped. The native of Mexico saved enough to buy a new $380,000 home in 2006 in the Lennar development of La Morada, where foreclosures are rampant. She fears her home could be next without federal help.While the current price of a home is related to willingness of the owner to pay, it has nothing to do with the ability to make those payments unless that home was purchased as a speculative investment and in need of appreciation to make due. Lets use Rosa's $380,000 home purchase as an example (a price that was almost twice the 2006 national median home value at the time). Just three years after the home was purchased, she and her family can no longer afford to make the monthly payments without federal help. Thus, at initiation there were two distinct possibilities:

- Home prices rise = Rosa would have sold the home for a profit or refinanced the home to tap into the new equity to make monthly payments

- Home prices fall = Rosa defaults and walks away

If the government wants to help individuals stay in their homes... fine, but please give the taxpayer ownership of those assets if it involves taxpayer money.

But, Will the Plan Work?

It better for the cost of the plan. Unfortunately, I only see the benefit as being 'on the margin' and we need more than an 'on the margin' benefit for the size of the bailout, which is huge when broken down. The basic details of the plan are as follows:

The mortgage plan is hoping to help 9 million individuals at a cost of $275 billion. This comes out to $30,000 PER BAILOUT or 20% of the current value of the median home PER BAILOUT! While I don't question the government's ability to spend $275 billion, I do question the 9 million figure based upon my hypothesis that home prices NEED to eventually reach their natural price level (use the chart below to determine the cost per bailout based upon whatever estimate you want to use).

The question I've asked myself (as a non-homeowner who is looking to purchase); would I be willing to pay $200,000 for something I believe is worth $150,000, even if my monthly payments are the same due to subsidized financing? Of course not! What if I want to move in the next 5, 10, or even 15 years? In that case the house gets marked to market and I lose my $50,000 relative excess. Thus, my theory is that regardless of this plan, home prices still have room to fall.

It is clear the administration believes that solving the housing problem is more important than the moral hazard being introduced. If that's the case, here is my alternative... reduce the principal owed on these mortgages IF they are already taxpayer owned (i.e. a Fannie / Freddie mortgage - leave private loans out of taxpayers hands). If they want to blow $275 billion for 9 million people, then reduce the principal by that 20% per bailout amount.

In other words, if prices are going to fall anyway, why prevent the inevitable? Renowned investor Wilbur Ross seems to echo these sentiments (Housing Wire via Naked Capitalism):

“The price of housing needs to be cleaned out. The Obama administration could right-size every underwater home and reduce principal to fit the current market value of the home. If they are going to deal with it they have to deal with it in a severe way,” Ross told HousingWire. “They also really need to consider all borrowers who are underwater, and not just the ones that have gone into default.”

The Homeowner Affordability and Stability Plan does some of that, but doesn’t go far enough, Ross suggested. “The have to reduce the principal amount of loans, not just nonperforming loans, but also performing ones,” he told CNBC. “Why should a guy who’s not paying benefit, while some poor citizen who’s struggling to make the payments gets stuck with the mortgage?”

Well said. I too am in the bottom left of the game theory chart for my primary residence. This only serves to lengthen the time I will wait before buying. Prices will eventually correct to incomes/rents and then we can purchase without having too much risk for invested equity. Unfortunately now the rent ratio matters much more because housing will be significantly less liquid due to measures like this: Be sure you can profitably move out and rent what you end up owning.

ReplyDeleteThese bailouts prolong the inevitable and drag out price declines for far too long. Home debtors would themselves be better off walking away but our culture of 'home ownership' prevents this from being acceptable to most. A novel political approach would be to remove the stigma from renting so that people can do what is best for their personal balance sheets.

the circle of life deserves a post of it's own. I want to see that get picked up by someone...

ReplyDelete